All other trademarks are the property of their respective owners. Truist, LightStream, and the LightStream logo are service marks of Truist Financial Corporation. Pay ment example: Monthly payments for a $10,000 loan at 5.49% APR with a term of 3 years would result in 36 monthly payments of $301.91. Advertised rates and terms are subject to change without notice. Rates without AutoPay are 0.50% points higher.

AutoPay discount is only available prior to loan funding. Excellent credit is required to qualify for lowest rates. *Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. To find the best rates for those with military connections, we looked at rates offered by USAA Bank, Navy Federal Credit Union, Pentagon Federal Credit Union and Randolph-Brooks Federal Credit Union, and chose the one with the lowest advertised APR for a traditional new car loan not including any other discounts that may be available, such as breaks for using a car-buying service. We also looked at the advertised starting car loan rates of large, national lenders to compare. However, if you'd like to finance for 84 months, GM Financial is offering 3.9 APR. GM Financial The 2017 Chevy Cruze benefits from a range of offers like 1,500 cashback or 1.9 financing for 60 months. We wanted to know: 1) which lenders consumers chose most often, and 2) which ones offered the lowest average APR. Here are some cases in which you can get a special rate on an 84 month loan. The number of months n is 60.We examined closed LendingTree auto loans from H1 2022. Interest compounds monthly and the periodic inerest rate i is the interest rate per month in decimal form. The principal, or present value (PV) of the loan is $15,000 + $200 = $15,200. Suppose you are purchasing a car for $15,000 and financing the purchase at 5% for 5 years (60 months) and you will pay a $200 financing fee rolled into the loan. This is a one-year loan at an interest rate of 10% and an APR of 25%. At the end of the year I will owe you 20 + (20 x 10%) + 3 = 20 + 2 + 3 = $25. And I can pay you the fee at the end of the year. Now suppose you lend me $20 for a year at 10% interest, but you are also charging me a $3 fee. This is a one-year loan at an interest rate of 10% and an APR of 10%.

At the end of the year I will owe you 20 + (20 x 10%) = 20 + 2 = $22. Suppose you lend me $20 for a year at 10% interest. However, if you have additional fees rolled into the loan, yourĪPR will be higher than the stated interest rate If you take a mortgage for $100,000 at an interest rate i with no additional fees thenĪPR. (Some fees are not considered "financing charges" so you should check with your lending institution.) This cost includes financing charges and any fees or additional charges associated with the loan such as closing costs or points. What is APR?ĪPR represents the average yearly cost of a loan over the term of the loan. We calculate 1) the monthly payment based on the actual loan amount then 2) back-calculate to a new interest rate - which is the APR - as if this payment was made on just the amount financed. APR CalculationsĪPR of a loan with additional fees or points rolled into the amount borrowed.

#Car loan calc 84 mos plus#

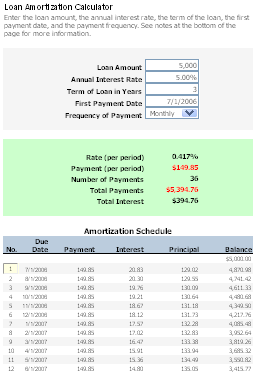

Total Payments The sum of total loan principal plus total financing charges. Total Loan Principal The total amount financed, including original principal loan amount plus financing fees rolled into the loan. Total Financing Charges The sum of all financing fees plus all interest paid over the course of the loan the total cost of having the loan. This does not include interest paid over the course of the loan. Financing Fees The sum of all additional costs involved in the loan transaction including points, fees, closing costs, processing fees, etc. Term The number of months (number of payments) required to repay the loan. Interest Rate The annual interest rate or stated rate on the loan. Loan Amount The original principal on a new loan or remaining principal on a current loan.

You can also create an amortization schedule for your loan principal plus interest payments.Īdvanced APR Calculator for APR calculations that include interest compounding and payment frequency options. The work to calculate monthly payments is shown below: This means that every month you will pay 377.42 for your shiny new car. The annual interest rate is 5.0, so the monthly rate is 5.0 divided by twelve. Input your loan amount, interest rate, loan term, and financing fees to find the APR for the loan. The present value here is 20,000, which is the value of the loan. The APR is the stated interest rate of the loan averaged over 12 months. This basic APR Calculator finds the effective annual percentage rate (APR) for a loan such as a mortgage, car loan, or any fixed rate loan.

0 kommentar(er)

0 kommentar(er)